It’s no secret that the trucking industry is in the midst of a truck driver shortage. For the past 15 years, trucking companies have had a major struggle in hiring and retaining drivers. A report from the American Trucking Association (ATA) says that more than 70% of goods consumed in the U.S. are moved by truck, but the industry needs to hire almost 900,000 more drivers over the next decade (90,000 per year) to meet rising demand. ATA estimates that the 2015 shortage of drivers was 45,000 and at the current trends, the shortage could balloon to more than 175,000 by 2024.

HOW DID THIS HAPPEN?

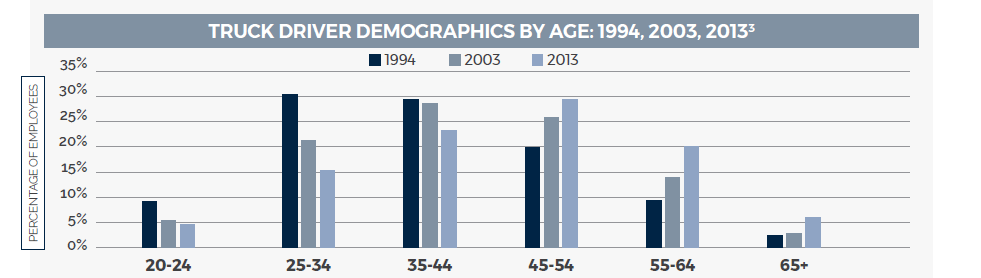

There are multiple causes for the rising shortage, one of the largest factors being the relatively high average of age in the existing workforce. Studies show that the average driver age in the for-hire-over-the-road truckload industry is 49, and other trucking sectors have an even higher average age, like less-than-truckload and private carriers. As these drivers retire, there is a struggle to replace them with younger drivers.

WHAT’S THE IMPACT?

The impact is significant. The driver shortage affects the entire supply chain industry as 70.6% of all freight tonnage is moved on the nation’s highways. According to the American Transportation Research Institute, 43% of costs are carrier-related costs. (Call out box) As volumes increase, the existing driver pool is even more strained. That means an increase in hiring costs. As the competition increases for the limited pool of drivers, wages will increase too. Long term, an enduring driver shortage may also impede industry-wide freight volumes and result in a modal switch as shippers look for reliable ways to bring their goods to market.

Want to learn more? Download our Trucking Industry Trends eBook.

Leave A Comment